Table Of Contents:

- Introduction to Emerging Market Investing in 2025:

- Top Tech-Driven Trends in Emerging Markets:

- Green Energy Investments – A Profitable and Sustainable Trend:

- Infrastructure Boom in Developing Economies:

- The Rise of ESG Investing in Emerging Markets:

- Major Risks and Challenges for Investors:

- Smart Investment Strategies for Emerging Markets:

- Conclusion: Where Emerging Market Investing is Headed?

- FAQs – Profitable Trends to Watch in Emerging Market Investing:

- Q1. Why should I consider investing in emerging markets in 2025?

- Q2. What are the key risks associated with emerging market investments?

- Q3. Which sectors in emerging markets show the most promise?

- Q4. How can I effectively diversify my investments in emerging markets?

- Q5. What role does foreign direct investment (FDI) play in emerging markets?

- Q6. Are there any notable trends in private equity within emerging markets?

- Q7. How does the performance of emerging markets compare to developed markets?

- Q8. What impact do global economic trends have on emerging markets?

- Q9. How can investors stay informed about emerging market opportunities?

- Q10. What strategies can help mitigate risks in emerging market investing?

Introduction to Emerging Market Investing in 2025:

Emerging markets have always promised high growth, but in 2025, they’re offering more than just potential. They’re becoming central to the global investment conversation. For anyone navigating today’s markets, whether you're managing a diverse portfolio or just getting into the game, these regions are offering some of the most dynamic opportunities out there.

Let’s explore why emerging markets are capturing attention right now and what makes them particularly appealing this year.

Why Emerging Markets Deserve Your Attention in 2025:

According to the latest IMF outlook, developing economies are expected to grow at over 4.2 percent this year. That’s nearly triple the projected growth for developed nations. This growth isn’t just about recovery. It’s about transformation.

Young, Digitally Connected Populations:

Emerging markets are powered by demographics. Countries like India, Indonesia, Nigeria, and Vietnam have large, youthful populations. India, for instance, has more than 65 percent of its population under the age of 35. That creates ongoing demand for digital services, mobile banking, consumer goods, and infrastructure that supports a modern economy.

These aren’t just numbers on a spreadsheet. They represent people entering the workforce, spending more, and driving long-term consumption trends.

Financial Systems with Room to Grow:

In many developing nations, a significant share of the population remains unbanked. That may seem like a problem, but it’s also a massive opportunity. Fintech is filling the gap in a big way. In Africa alone, digital financial services are projected to generate $150 billion in revenue annually by 2025, according to McKinsey.

These are markets leapfrogging traditional banking and embracing mobile payments, peer-to-peer lending, and digital wallets. For investors, it’s like getting in on the ground floor of financial modernization.

Policy Shifts and Government Support:

Another major factor behind the emerging market momentum in 2025 is the increasing support from both local governments and international institutions. Countries like Mexico, India, and Vietnam have introduced regulatory reforms that make it easier for foreign investors to participate.

In China, despite recent real estate struggles, policymakers are rolling out targeted stimulus to stabilize financial markets and shore up domestic confidence. At the same time, organizations like the World Bank and IMF are directing significant funding into infrastructure, clean energy, and digital development, helping reduce barriers and promote sustainable growth.

Opportunities and Risks: What Makes Emerging Markets Attractive Today?

Of course, the story wouldn’t be complete without looking at both sides. Investing in emerging markets can be incredibly rewarding, but it also comes with unique challenges. Let’s break down the current opportunity set and the potential pitfalls.

Key Opportunities in 2025:

- True Diversification: Emerging markets often move differently from developed ones. Adding them to a portfolio can improve risk-adjusted returns, especially when U.S. and European markets are facing slower growth.

- Sector-Specific Growth: Certain industries in emerging markets are growing rapidly. Clean energy, digital finance, healthcare, e-commerce, and agri-tech are just a few sectors attracting serious capital. Southeast Asia’s e-commerce market alone is on track to hit $250 billion in 2025.

- Attractive Valuations: Unlike many developed market equities that are trading at high valuations, emerging market stocks and bonds often offer better value. For income-focused investors, local currency bonds can also provide higher yields.

Risks to Watch For:

- Political and Regulatory Instability: Political uncertainty and inconsistent regulation are still a concern in some regions. Sudden policy shifts or elections can affect the investment environment quickly.

- Currency Volatility: Currency fluctuations remain one of the biggest risks. A strong dollar can erode local returns, and currency devaluations can hurt even strong companies.

- Liquidity Limitations: In less developed markets, selling assets quickly is not always easy. This can make it harder to react to market shocks or exit a position without incurring losses.

Final Thoughts – A Balanced Approach for a Promising Year:

In 2025, emerging markets aren’t just side bets. They are becoming essential to a well-rounded investment strategy. The combination of growth potential, demographic trends, digital innovation, and policy support is creating serious momentum.

Yes, risks exist. But with thoughtful research and a balanced approach, the rewards can outweigh the volatility. Whether you’re looking for growth, income, or diversification, emerging markets offer a lot to explore.

Keep your eyes open, stay informed, and consider how these dynamic regions could strengthen your portfolio. This year, they may not just be part of the conversation. They might lead it.

Top Tech-Driven Trends in Emerging Markets:

If you’ve been watching global markets in 2025 and wondering where the real momentum is building, you might want to shift your gaze to the Global South. From bustling streets in Lagos to fintech labs in Jakarta, emerging markets are no longer catching up — they’re often setting the pace in tech innovation. What’s especially exciting this year is how technology isn’t just enhancing economies; it’s transforming them at the core.

Let’s take a closer look at three powerful tech-driven trends that are not only shaping the investment landscape but also redefining how millions of people live, work, and access opportunity.

E-commerce Expansion – Online Retail Is Gaining Serious Ground:

For many consumers in emerging economies, their first meaningful interaction with the digital world is through a shopping app. The e-commerce boom is no longer just about catching up with the West — it’s about leapfrogging traditional retail models altogether.

Take Latin America, where MercadoLibre — often referred to as the Amazon of the region — is investing $2.6 billion in Argentina alone in 2025. That’s a 53% increase from the previous year, aimed at expanding warehouses, speeding up logistics, and improving its digital payment infrastructure. They’re also planning to add 2,000 new jobs, showing that growth here is both digital and on the ground.

Across Southeast Asia, digital commerce is surging as well. The region has over 200 million internet users already, with projections that this number could triple by 2025. Much of this growth is mobile-first, meaning consumers are skipping desktop shopping and heading straight into app-based purchases. This change in behavior is fueling massive investments in last-mile delivery, payment platforms, and digital marketing ecosystems.

What’s important to realize as an investor is that this is not just about retail. It’s about creating digital economies where people can earn, spend, save, and borrow entirely online. That ecosystem opens up rich opportunities in logistics, payments, supply chain tech, and even AI-based recommendation engines for local markets.

Fintech Revolution – Financial Access Is Being Reinvented:

Fintech is arguably the most transformative force in emerging markets today. In places where banks have been slow or limited in reach, fintech companies are filling the gap with impressive speed.

Let’s look at Africa, where mobile money services like M-Pesa have revolutionized personal finance. More than 60% of the population now uses mobile phones to manage money — not just to pay bills, but to access loans, send remittances, and build savings. Companies like JumiaPay, the financial arm of Jumia (Africa’s leading e-commerce platform), are rapidly scaling digital wallets and embedded finance products.

In the MENAP region (Middle East, North Africa, Afghanistan, and Pakistan), the fintech ecosystem has exploded with around 800 active startups. From micro-lending platforms in Egypt to digital banks in the UAE, this sector is on fire. However, growth isn’t guaranteed. According to McKinsey, MENAP fintechs will require between $5 billion and $7 billion in additional funding over the next three years just to maintain momentum.

This presents a real window for investors. You’re not just investing in apps or startups — you’re investing in financial inclusion, in digitizing economies, and in leapfrog solutions that could redefine how money moves across borders and communities.

What’s even more compelling is the impact. These platforms are providing credit to small business owners, access to insurance for rural farmers, and savings tools to people who’ve never had a bank account before. It's tech with purpose — and profit potential.

Digital Infrastructure Growth – Laying the Foundations of a Connected Future:

All this digital activity needs something solid to stand on, and that’s where digital infrastructure comes in. Think of it as the plumbing behind the tech revolution — data centers, fiber optics, cloud networks, and power grids. Without it, none of this digital magic works.

Globally, however, challenges are emerging. According to the International Energy Agency (IEA), the development of data centers and AI infrastructure is facing new headwinds. Trade disputes and supply chain disruptions between major players like the U.S., China, and the EU could slow progress. These regions account for nearly 80% of the projected growth in data center electricity demand by 2030, so any disruption here has ripple effects worldwide.

For investors, this is a space that deserves close attention. Infrastructure investments may not feel as glamorous as high-growth apps, but they are foundational. Countries and companies investing early in connectivity, energy efficiency, and cloud computing capacity could see long-term returns and strategic advantages.

Why These Trends Matter for Investors Right Now:

Emerging markets in 2025 are not just catching the tech wave. They’re shaping it. E-commerce is scaling faster, fintech is solving real-world problems, and digital infrastructure is becoming a top priority. This trifecta of transformation creates fertile ground for innovation and investment.

That said, these markets are not without their risks — currency volatility, regulatory shifts, and funding gaps can throw curveballs. But for investors willing to do their homework, understand local dynamics, and ride out the volatility, the upside is hard to ignore.

Tech in emerging markets is no longer a niche play. It’s a core strategy for future-focused portfolios.

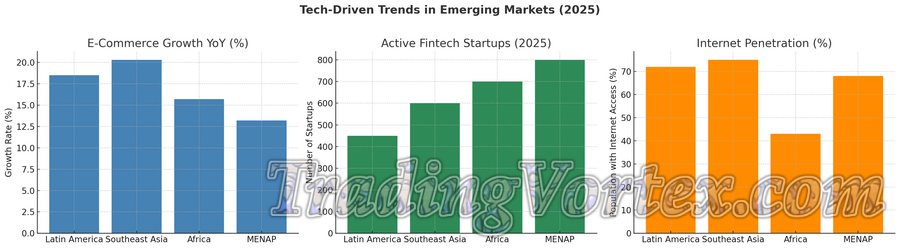

How tech is transforming emerging markets in 2025: 1. E-Commerce Growth: Southeast Asia is leading with over 20% annual growth, closely followed by Latin America. This highlights the urgency of investing in logistics, digital payments, and scalable platforms in these regions. 2. Fintech Startups: The MENAP region is buzzing with fintech activity, boasting around 800 active startups. Africa isn’t far behind, showing just how quickly the continent is closing financial gaps with mobile-first solutions. 3. Internet Penetration: Southeast Asia and Latin America have the highest internet penetration, creating fertile ground for digital services. Africa still has room to grow, which could translate into long-term upside as infrastructure expands.

How tech is transforming emerging markets in 2025: 1. E-Commerce Growth: Southeast Asia is leading with over 20% annual growth, closely followed by Latin America. This highlights the urgency of investing in logistics, digital payments, and scalable platforms in these regions. 2. Fintech Startups: The MENAP region is buzzing with fintech activity, boasting around 800 active startups. Africa isn’t far behind, showing just how quickly the continent is closing financial gaps with mobile-first solutions. 3. Internet Penetration: Southeast Asia and Latin America have the highest internet penetration, creating fertile ground for digital services. Africa still has room to grow, which could translate into long-term upside as infrastructure expands.

Green Energy Investments – A Profitable and Sustainable Trend:

If there's one trend in emerging markets that's managing to excite environmentalists, energize policymakers, and reward investors at the same time, it's green energy. We're talking solar farms rising from arid landscapes, wind turbines spinning above rural hills, and clean tech startups reshaping how communities power their lives. And in 2025, this movement isn’t slowing down. It’s accelerating.

So, let’s unpack what’s really happening on the ground in emerging markets and why it might be one of the smartest plays in your investment strategy this year.

Surging Demand for Solar, Wind, and Clean Tech:

Clean energy is no longer a luxury or a “nice to have.” For many emerging economies, it’s the most practical and cost-effective path forward. And we’re not talking about small-scale pilot programs anymore. Investment in solar, wind, and clean tech is now surpassing traditional energy sources in several regions.

According to the International Energy Agency (IEA), the global market for key clean energy technologies like solar photovoltaics, wind turbines, EV batteries, electrolysers, and heat pumps is set to more than triple by 2035, surpassing $2 trillion. That’s not just a boom. That’s a global transformation.

In India, solar and wind are powering not just homes, but entire cities. India now ranks among the top three global markets for solar deployment, and recent policy shifts are channeling billions of dollars into grid modernization and large-scale renewable projects.

Latin America is another fast mover. Countries like Chile and Brazil are building massive solar and wind parks to reduce reliance on imported fossil fuels. In Brazil, over 85% of the electricity already comes from renewable sources, and the government continues to double down on clean tech to reach ambitious emission reduction targets.

Let’s not forget Africa, where clean tech innovation is addressing energy poverty in creative ways. From off-grid solar kits to pay-as-you-go microgrids, green energy is becoming the gateway to economic empowerment for millions. In many rural communities, people are accessing electricity for the first time through solar mini-grids, not coal plants.

For investors, this momentum is more than just promising — it's actionable. Startups and established firms alike are racing to capture this demand. Whether you're looking at solar panel manufacturers, smart grid solutions, or battery storage innovators, there's plenty of room to participate in this expansion.

Government Incentives Driving Renewable Energy Growth:

Behind every successful renewable energy boom is usually a supportive government — or several. Incentives are playing a massive role in fast-tracking clean energy adoption across the developing world.

In Southeast Asia, Vietnam’s Feed-in Tariff program has dramatically boosted solar power adoption, while Indonesia has announced a $20 billion Just Energy Transition Partnership (JETP) to phase out coal and scale up renewables.

The African Union and development banks are ramping up their support as well. The African Development Bank (AfDB) is actively financing renewable energy infrastructure, from large-scale solar farms in Egypt to off-grid projects in West Africa.

In Latin America, policies such as Brazil’s national biofuels program and Colombia’s tax incentives for green investments are sending strong signals to investors.

And globally, the shift is gaining high-level support. The IEA reports that more than $1.8 trillion is expected to be invested in clean energy this year, with nearly $300 billion allocated specifically to emerging and developing economies.

These incentives not only de-risk investments but also create stable frameworks for long-term returns. If you're a long-game investor, this policy tailwind can be the difference between short-term hype and sustainable growth.

Emerging Market Leaders in Green Energy Adoption:

Now let’s shine a light on a few of the standout players in the emerging world.

- Brazil is leading by example. As the host of COP30 in 2025, the country has committed to cutting emissions by as much as 67% by 2035, using a mix of hydro, solar, wind, and biofuels. Beyond policy, Brazil is becoming a green energy innovator, attracting foreign investments in everything from hydrogen to sustainable aviation fuel.

- Morocco is another rising star. With one of the largest solar farms in the world — the Noor Ouarzazate complex — Morocco is exporting clean energy to Europe and positioning itself as a renewable energy hub for North Africa.

- India, with its ambitious goal of reaching 500 GW of non-fossil fuel capacity by 2030, continues to attract billions in green energy investments, including private capital from tech giants and sovereign wealth funds.

- South Africa is pushing ahead with its Just Energy Transition plan, aiming to shut down aging coal plants and replace them with wind and solar. It's backed by an $8.5 billion funding package from international partners.

Even in less obvious regions like Central Asia, countries like Uzbekistan and Kazakhstan are stepping up with large-scale renewable projects to diversify their energy sources and reduce emissions.

These are not isolated efforts. They're part of a broader movement where green energy is becoming a strategic pillar of economic development. That’s why many international investors are starting to treat clean energy in emerging markets not as a speculative bet, but as a core growth category.

Why This Trend Deserves a Spot on Your Radar:

Let’s be honest. Sustainable investing can sometimes sound like a marketing buzzword. But in the case of emerging markets and green energy, the numbers tell a different story. This trend checks all the boxes: rising demand, government support, technological innovation, and strong long-term growth potential.

It’s also future-proof. As climate regulations tighten and fossil fuel costs become increasingly volatile, clean energy assets are likely to hold their value — or grow even faster.

Plus, there's something incredibly rewarding about putting your capital into a sector that isn't just about making money. It’s about making a measurable difference.

So whether you're an ESG-focused investor, a macro trader looking for the next growth wave, or someone who just wants their portfolio to be a little more forward-thinking, green energy in emerging markets is worth more than a glance. It's worth serious consideration.

Bottom line? The green energy revolution in emerging markets is already underway, and in 2025, it's offering some of the most exciting investment opportunities we’ve seen in years. The only real question is: will you get in while it’s scaling up?

Here's a chart that visualizes the upward trend in green energy investments across emerging markets from 2021 to 2025. As you can see, solar continues to dominate, but wind and clean tech are quickly catching up. This reflects the growing diversification and scale of green energy projects in these regions — key signals for long-term growth potential. Let me know if you'd like a complementary data table or region-specific breakdown as well.

Infrastructure Boom in Developing Economies:

When we talk about the future of investing in emerging markets, one area that consistently promises growth and long-term value is infrastructure. As the global economy shifts toward urbanization, new technology, and climate-conscious development, the demand for robust infrastructure is reaching a fever pitch in developing economies. But why should investors care about this trend, and how can they leverage it to capture profitable opportunities?

In 2025, the infrastructure boom is about more than just building roads and bridges. It's about creating the modern backbone of economies that can support megacities, energy transition projects, and technological advancements. Let’s break down the key elements driving this boom and explore where the most significant opportunities are arising.

Urbanization and Megacity Projects Driving Construction:

Urbanization is transforming the global landscape, particularly in emerging economies. By 2050, nearly 7 out of 10 people will live in urban areas, and more than 90% of that growth will happen in Asia and Africa (UN Population Division). As the world urbanizes, cities in developing economies are becoming vibrant economic hubs — but they need a lot of infrastructure to keep up with growing populations.

Megacity development is one of the most significant trends of our time. Megacities (urban areas with populations exceeding 10 million) are already home to over 500 million people worldwide, and that number is expected to grow. According to McKinsey & Company, global urban infrastructure investment will need to hit around $4 trillion annually by 2030 to meet the needs of rapid urbanization.

Furthermore, Africa’s population is projected to double by 2050, making urban infrastructure development an urgent priority. Cities like Lagos, Nigeria and Kinshasa, DRC are already experiencing explosive growth, and governments are scrambling to develop infrastructure to match this trend.

Here are some key stats:

- In 2025, 60% of the global population will live in cities, with emerging markets absorbing most of the urban growth.

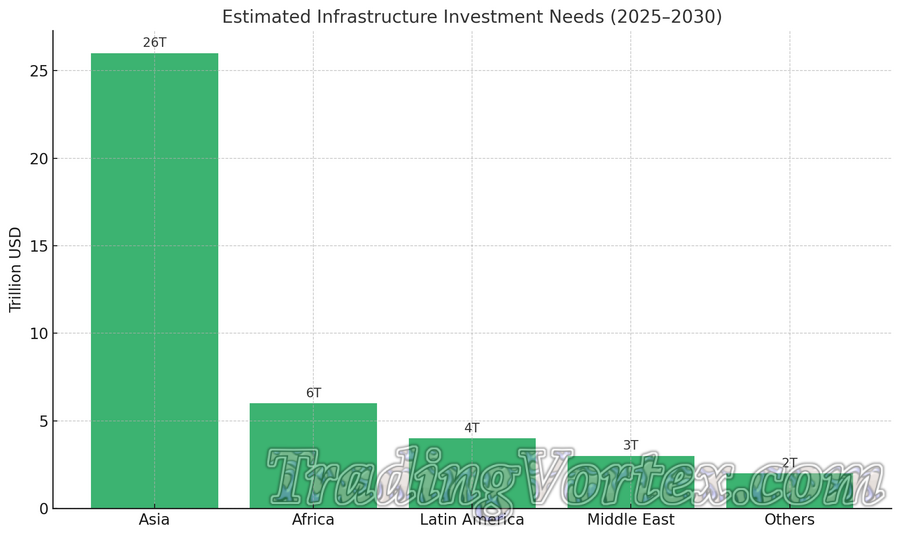

- The Asian Infrastructure Investment Bank (AIIB) estimates that Asia alone needs $26 trillion in infrastructure investments by 2030.

For investors, urbanization creates opportunities in construction, transportation, energy, and real estate development. The push to build new cities and modernize existing ones will be a catalyst for growth in emerging economies.

Public-Private Partnerships Reshaping Infrastructure Development:

As governments struggle to keep up with infrastructure demands, Public-Private Partnerships (PPPs) have become a critical tool in financing large-scale projects. These partnerships allow private companies to contribute capital, expertise, and efficiency while governments retain oversight, often guaranteeing a return on investment through long-term contracts.

In Latin America, Colombia has embraced PPPs to develop critical infrastructure, including roads, bridges, and urban transport systems. The Bogotá Metro project, a major urban transit initiative, is one of the most significant PPP-driven projects in the region, with an estimated cost of $5 billion.

In Africa, the trend is also gaining traction. The $1.5 billion Mombasa-Nairobi Railway in Kenya is an example of a PPP that has successfully revitalized the country’s transport infrastructure. By leveraging private sector expertise, the project has helped boost efficiency while also providing investors with attractive returns.

Global Investment in PPPs continues to grow. According to the World Bank, emerging markets accounted for more than 50% of global PPP investment in infrastructure in recent years. This trend is only expected to expand as governments look for new ways to finance massive infrastructure needs.

Here’s why PPPs are attracting investors:

- Lower risk: Risk is shared between the public and private sectors.

- Long-term revenue streams: Investors often receive steady returns from tolls, utilities, and maintenance contracts.

- High returns on capital: Private sector expertise allows for more efficient and cost-effective projects.

In 2025, this trend is expected to intensify, particularly in sectors like transportation, energy, and utilities, providing an ongoing stream of opportunities for investors looking to make a mark in infrastructure.

Hotspots for Infrastructure Investment in 2025:

Now that we understand the macro trends, let’s focus on where investors should be paying attention. Here are some key hotspots in 2025 for infrastructure investment in developing economies:

- India and Southeast Asia: India remains one of the top destinations for infrastructure investment. The country’s urban infrastructure needs are vast, and initiatives like the Smart Cities Mission and National Infrastructure Pipeline (NIP), which aims to invest $1.5 trillion in infrastructure, will continue to fuel growth. Additionally, Southeast Asia is experiencing rapid urbanization, with countries like Vietnam, Thailand, and Indonesia investing in airports, roads, and ports to support growing economies.

- Africa: Africa’s infrastructure demand is particularly high due to its rapidly expanding population. The African Union’s Programme for Infrastructure Development in Africa (PIDA) aims to integrate the continent’s infrastructure by focusing on transport, energy, and water projects. Countries like Kenya, Nigeria, and South Africa are leading the charge, with $100 billion earmarked for transport infrastructure alone.

- Latin America: In Brazil, the government’s focus on sustainable urban development is creating lucrative opportunities in infrastructure investment. Mexico is another growing hotspot, especially in the renewable energy sector, with investments in solar and wind projects ramping up to meet the country’s clean energy goals.

- The Middle East: The Middle East is investing heavily in both traditional infrastructure (such as roads and airports) and cutting-edge projects like smart cities and renewable energy. Saudi Arabia’s Vision 2030, aimed at diversifying the economy, includes over $500 billion in infrastructure projects, including the futuristic Neom city. The UAE, Qatar, and Oman are also making significant investments in their urban and transport infrastructure.

Navigating the Investment Landscape – Key Considerations:

Investing in infrastructure in developing economies offers substantial returns, but it requires careful consideration. Here are a few things to keep in mind when navigating this sector:

- Political Risk: Infrastructure projects can be heavily influenced by local politics, so it's important to evaluate the stability of the region or country you are investing in.

- Long-Term Commitment: Infrastructure investments are typically long-term, requiring patience. However, the steady cash flow generated by tolls, utilities, or service contracts can provide reliable returns.

- Regulatory Framework: Ensure the legal environment supports private investment, and evaluate the government’s ability to honor long-term contracts and guarantee returns.

- Environmental and Social Factors: Given the emphasis on sustainability, look for projects that align with green initiatives and social impact goals, as these are increasingly valued by both governments and investors.

Conclusion – The Golden Age of Infrastructure Investment:

The infrastructure boom in developing economies presents one of the most promising investment trends for 2025. With urbanization driving demand for new cities and mega-projects, public-private partnerships becoming the financing norm, and certain regions showing tremendous growth potential, there has never been a better time to consider infrastructure as a core component of your investment portfolio.

If you’re looking for solid, long-term returns with the added benefit of contributing to economic development and sustainability, infrastructure in developing economies offers a high-reward opportunity. Just make sure to stay informed about the latest trends, political developments, and regulatory changes to navigate this complex yet lucrative sector.

Here’s a visual breakdown of the estimated infrastructure investment needs across regions from 2025 to 2030. As you can see, Asia is by far the leader in projected investment, with an estimated $26 trillion needed, followed by Africa and Latin America. This illustrates where the largest growth opportunities are expected and helps investors better prioritize regional strategies based on capital flow and development demand.

The Rise of ESG Investing in Emerging Markets:

You’ve probably heard ESG investing mentioned more frequently in the past few years, and for good reason. Environmental, Social, and Governance (ESG) criteria have shifted from buzzwords to critical benchmarks for investors seeking sustainable, long-term growth. While the ESG movement started in developed markets, emerging economies are now stepping into the spotlight, and they’re doing it with increasing confidence and clarity.

Let’s take a closer look at why ESG is becoming essential in emerging market strategies, the hurdles investors face on the ground, and the long-term value that makes this more than just a passing trend.

Why ESG Is Becoming a Must-Have for Emerging Market Portfolios:

For a long time, ESG was considered a luxury — something investors looked into after all the "real" financial analysis was done. But that view is rapidly changing, especially in emerging markets. Today, ESG is seen not just as a feel-good checkbox but as a powerful tool for identifying quality investments and minimizing risk.

Growing Investor Appetite:

Institutional investors, sovereign wealth funds, and even retail investors are actively reallocating capital into ESG-compliant assets. According to Morningstar, global sustainable fund assets hit over $3 trillion by the end of 2024, and emerging markets are now a growing piece of that pie. Funds like the iShares ESG Aware MSCI EM ETF (ESGE) have gained traction as investors look for ways to align their portfolios with environmental and social values without missing out on emerging market growth potential.

Policy Push and Regulatory Progress:

Governments in regions like Southeast Asia, Latin America, and parts of Africa are realizing that sustainable development and capital attraction go hand in hand. Countries such as Brazil, India, and Indonesia have made notable advances in climate-related financial disclosures and green financing frameworks. For example:

- India has made ESG disclosures mandatory for the top 1,000 listed companies, making it one of the most ESG-forward emerging economies.

- South Africa’s Johannesburg Stock Exchange requires listed companies to report on sustainability, including social and governance practices.

- Chile recently issued Latin America's first sovereign sustainability-linked bond, tying national debt repayment terms to ESG performance metrics.

All of these initiatives are aimed at building investor confidence while supporting broader sustainability goals.

Corporate Transformation and Consumer Demand:

On the corporate side, companies are responding to both regulation and growing consumer expectations. A growing middle class in these regions is increasingly aware of environmental and social issues. That means companies with sustainable supply chains, labor practices, and carbon-reduction plans aren’t just more responsible — they’re more competitive.

Overcoming ESG Challenges in Developing Countries:

Integrating ESG in emerging markets isn't as straightforward as ticking a few boxes on a checklist. The road can be bumpy, with a few potholes along the way — but that doesn’t mean it’s not worth traveling.

Data Deficiency and Transparency Issues:

One of the biggest roadblocks is the lack of reliable ESG data. While reporting is improving, many companies either don’t have the resources or the know-how to produce credible sustainability reports. This makes it tough for investors to perform due diligence or compare ESG scores across markets.

But the gap is narrowing. Innovative tech solutions like satellite monitoring, blockchain for supply chains, and AI-driven ESG analytics are emerging to fill in the blanks. Platforms like Arabesque S-Ray and Refinitiv ESG are already using big data to score companies even in less developed regions.

Economic and Political Realities:

Developing countries often prioritize immediate economic growth and poverty reduction over long-term ESG goals. When faced with short-term economic pressures, some governments may turn to environmentally or socially harmful practices — think coal plants or relaxed labor laws — to stimulate growth quickly.

This doesn’t mean ESG can’t thrive. On the contrary, it highlights the need for patient capital, stakeholder engagement, and tailored ESG frameworks that reflect the realities of each country rather than applying a one-size-fits-all model.

Inconsistent Standards Across Borders:

Emerging markets lack a unified ESG standard, which complicates cross-border investing. What qualifies as sustainable in Vietnam might not meet the same standard in Mexico or Nigeria. Global coordination, led by groups like the International Sustainability Standards Board (ISSB) and Task Force on Climate-related Financial Disclosures (TCFD), is slowly improving consistency, but there’s still a long way to go.

Long-Term Value – How ESG Enhances Returns and Reduces Risk:

Let’s talk about the big question: does ESG really pay off?

Plenty of research says yes. ESG-aligned companies often display stronger governance, lower capital costs, and more loyal customer bases. In volatile emerging markets, those factors can be the difference between sustainable growth and sudden collapse.

Resilience in Uncertainty:

Think back to the COVID-19 crisis. Many ESG-compliant companies, particularly those focused on social governance (like employee well-being and supply chain ethics), weathered the storm better than others. They were quicker to adapt, more responsive to stakeholder concerns, and less exposed to reputational or regulatory risk.

Reduced Exposure to Environmental and Social Risks:

A mining company in Latin America that doesn’t manage its environmental footprint could face protests, fines, or shutdowns. A clothing manufacturer in South Asia with poor labor standards could be blacklisted by global brands. ESG due diligence helps investors avoid ticking time bombs that don’t show up in traditional balance sheets.

Market Outperformance:

Several studies — including those by MSCI and BlackRock — show ESG-integrated portfolios either match or outperform traditional strategies, especially in the long term. When you combine that with the growth trajectory of emerging markets, you get a compelling argument for ESG as both a value-aligned and return-enhancing strategy.

In Summary – ESG in Emerging Markets Is More Than a Trend:

ESG investing in emerging markets is no longer a fringe movement. It’s a major investment philosophy that’s reshaping how capital flows into developing economies. Yes, the challenges are real. But so is the potential.

As ESG becomes more ingrained in the financial ecosystem — from government bonds to venture capital — early adopters who learn to navigate these markets thoughtfully could find themselves ahead of the curve. With a bit of patience, a lot of research, and the willingness to engage in long-term value creation, ESG investing could be one of the smartest and most meaningful plays in your portfolio.

Because let’s be honest — making money is great, but making a difference while you’re at it? That’s next-level investing.

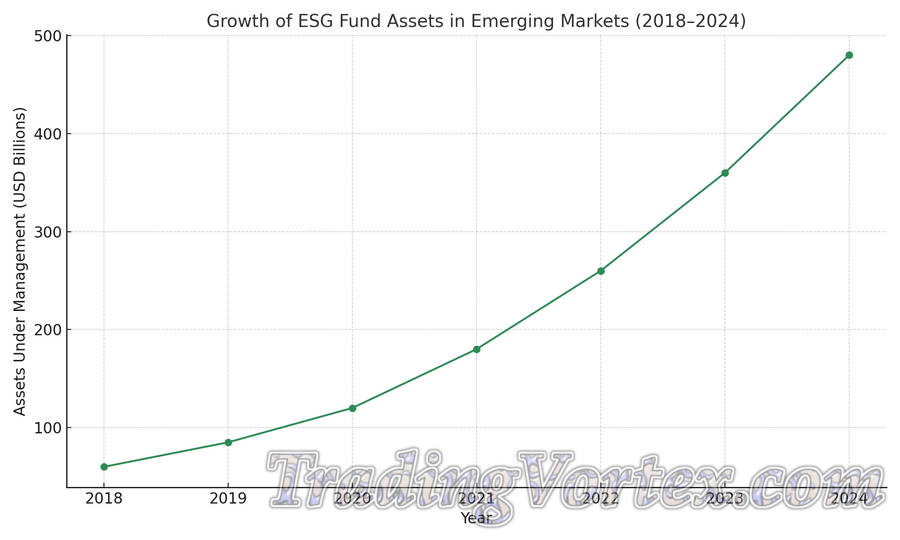

The chart illustrates the steady and significant growth of ESG (Environmental, Social, and Governance) fund assets in emerging markets from 2018 to 2024. Starting at approximately $60 billion in 2018, assets under management more than doubled by 2020 and continued climbing to reach around $480 billion by 2024. This upward trend reflects increasing investor demand for sustainable investment options, driven by greater awareness of environmental and social issues, regulatory support, and the long-term financial benefits of ESG integration. Emerging markets, once overlooked in this space, are quickly catching up as both global and local investors seek purpose-driven, resilient opportunities.

Major Risks and Challenges for Investors:

Understanding the Roadblocks Before You Accelerate: Let’s face it. Emerging markets can be incredibly exciting for investors, full of potential and untapped growth. But they’re not without their potholes. While there’s no reason to avoid these opportunities altogether, it’s essential to be aware of the risks that come with the ride. Whether you're new to the game or a seasoned investor diversifying across borders, recognizing these challenges can help you prepare smarter strategies.

Political Instability and Governance Uncertainty:

One of the most significant risks investors face in emerging markets is political instability. Think sudden leadership changes, civil unrest, unexpected policy shifts, or inconsistent enforcement of laws. These factors can shake investor confidence and alter the economic outlook of a country virtually overnight.

Why It Matters: Political risk doesn’t just affect stocks and bonds. It can lead to currency devaluation, nationalization of assets, or broken trade agreements.

How to Navigate It:

- Diversify across regions to reduce exposure to any single political risk.

- Monitor global events through trusted platforms and use geopolitical risk indexes.

- Consider investing through ETFs or funds that spread risk across multiple emerging economies.

Currency Volatility and Inflation Headwinds:

Another challenge that keeps emerging market investors on their toes is currency volatility. These economies often face wide swings in exchange rates due to weaker monetary policy frameworks, trade imbalances, or external shocks like oil prices or interest rate changes in the U.S.

In 2023 and 2024, the IMF noted that aggressive rate hikes in advanced economies, especially the U.S. Federal Reserve, put immense pressure on local currencies in emerging markets like Argentina, Turkey, and South Africa. Currency depreciation in these markets can eat into profits even when the local assets are performing well.

Inflation is another beast. Some countries have inflation rates well into double digits, driven by supply chain disruptions, food insecurity, or reliance on imported fuel.

Real-World Impact: You could gain 15% on a local stock, but if the currency weakens 20% against the dollar, your net return might actually be negative.

How to Navigate It:

- Use hedging tools or invest through funds that manage currency exposure.

- Favor markets with stronger central banks and more stable inflation control histories (e.g., Chile, Indonesia, or India).

- Keep an eye on commodity exposure, as many emerging economies rely heavily on commodity exports.

Legal, Tax, and Regulatory Complexities:

Not all emerging markets play by the same rulebook, and sometimes, the rules change mid-game. That’s why understanding the legal and regulatory environment is vital. A country might roll out tax reforms overnight, tighten foreign investment caps, or introduce restrictions on repatriation of profits.

Also, legal systems in some countries may lack transparency or efficiency. Dispute resolution can be slow or unpredictable, and intellectual property protections might be weak.

Hidden Costs: Navigating red tape or getting stuck in legal loopholes can delay projects or reduce returns.

How to Navigate It:

- Consult local legal and tax advisors before committing capital.

- Choose countries with investor protection frameworks, such as bilateral investment treaties.

- Rely on international arbitration mechanisms in your investment contracts when possible.

Bonus – Social Risk and ESG Blind Spots:

While environmental, social, and governance (ESG) considerations are increasingly important, not all emerging markets have mature ESG frameworks. Labor rights issues, poor corporate governance, and corruption can pose unseen risks, particularly for socially conscious investors.

Transparency International’s Corruption Perceptions Index consistently ranks many emerging nations low on governance. It’s not always about what’s written in the law, sometimes, it’s about how the rules are enforced.

How to Navigate It:

- Look into a company’s sustainability and transparency ratings.

- Favor firms that voluntarily adopt international ESG standards like GRI or SASB.

- Follow the track record of fund managers who specialize in sustainable emerging market investing.

Final Thoughts – Invest with Eyes Wide Open:

Emerging markets offer massive upside, but they demand more attention, research, and flexibility than more developed economies.

The best approach? Be cautiously optimistic. Equip yourself with local knowledge, choose the right instruments, and don’t be afraid to lean on experts or fund managers who live and breathe these markets every day.

As the saying goes in the investing world: “Risk is what’s left over when you think you’ve thought of everything.” So, the more you know and prepare, the more you tilt the odds in your favor. Let the risks inform your decisions — not paralyze them.

Smart Investment Strategies for Emerging Markets:

How to Maximize Returns While Managing Risk in a Fast-Moving Landscape?

Emerging markets offer a mix of promise and unpredictability. They’re where rapid growth meets complex challenges. For seasoned investors and beginners alike, smart strategy is your best friend. It's not just about spotting the next breakout economy, but about knowing how to ride the wave without wiping out.

Let’s break down the most effective approaches investors are using in 2025 to get ahead — and stay there.

Spread Your Bets – Diversify Across Countries, Sectors, and Asset Classes:

If there’s one golden rule in emerging market investing, it's this: Don’t put all your eggs in one emerging basket.

- Geographic diversification helps you sidestep country-specific risks like political instability or regulatory surprises. For example, if elections in Brazil throw markets into a spin, your holdings in Vietnam or Kenya might still perform well.

- Sector diversification is also key. A tech boom in India may offset slower growth in manufacturing elsewhere. Balancing exposure across fast-growing areas like renewable energy, e-commerce, and digital finance can stabilize returns.

- Asset class diversification goes beyond just equities. Bonds, infrastructure funds, sovereign debt, and even venture capital can provide access to different risk-reward profiles.

Pro Tip: Use low-cost ETFs or mutual funds tailored for emerging markets to gain broad exposure while managing fees.

Think Global, Act Local – Partner with Local Experts:

One of the biggest mistakes foreign investors make? Flying blind. Markets may be “emerging,” but they're anything but simple. Having someone on the ground who understands the terrain can make a huge difference.

- Local fund managers and analysts know how to read between the lines. They understand political risks, upcoming regulatory changes, and local consumer trends that international data may miss.

- Joint ventures and strategic partnerships can help you unlock access to industries that are otherwise tough to enter. Think of it as getting the keys to the local business culture — something algorithms alone can't provide.

- Legal advisors and compliance experts are essential in countries with complex or opaque regulations. They help ensure that your investment complies with all local laws and tax codes.

Real-World Example: Many successful investors in African tech startups, like Flutterwave and M-Pesa, credit their wins to close collaboration with local entrepreneurs and advisors.

Invest with Intelligence – Use Data and AI to Gain an Edge:

In 2025, data is more than power — it’s profit. Emerging markets can be chaotic, and traditional indicators don’t always tell the whole story. That’s where artificial intelligence and advanced analytics come into play.

- Machine learning models can analyze macroeconomic data, social sentiment, and even satellite imagery to forecast supply chain bottlenecks or real estate development trends.

- AI-driven screening tools help identify undervalued stocks, spot early-stage growth opportunities, and assess ESG (Environmental, Social, Governance) performance in real time.

- Risk management platforms powered by AI can monitor political events, regulatory shifts, or environmental disruptions that might affect your portfolio.

Case in Point: Hedge funds and institutional investors are using generative AI to simulate scenarios like currency crises or commodity shocks, helping them hedge smarter and act faster.

Blend Tech with Tactics – Practical Tools for the Modern Investor:

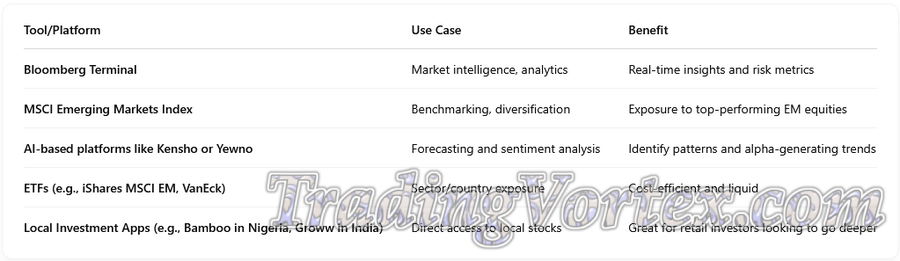

Here are some tools and tactics savvy investors are using right now:

Final Thoughts – Stay Flexible, Stay Informed:

There’s no one-size-fits-all playbook for emerging market investing. Conditions can change quickly — whether it’s a surprise election result, a currency wobble, or a new policy reform. That’s why smart investors stay agile. They adjust their strategies, tap into local insight, and use every tool available to make data-driven decisions.

Above all, they stay curious. Because in emerging markets, the next opportunity is often hiding just beneath the surface.

So whether you’re building your first position or managing a diversified portfolio across continents, keep your strategy flexible, your eyes open, and your network strong. That’s how you turn potential into performance.

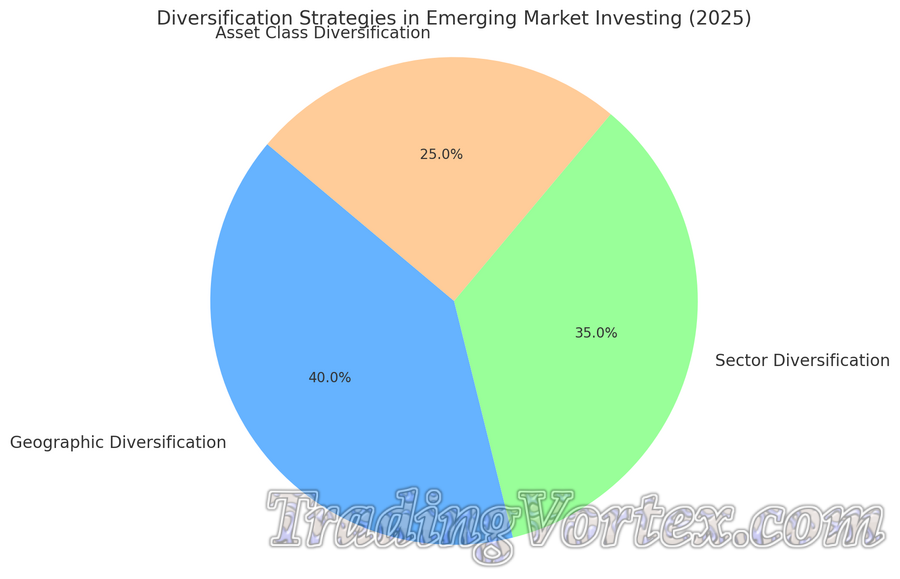

Visual representation of key diversification strategies investors are prioritizing in emerging markets. The pie chart highlights that geographic diversification remains the top approach, making up 40% of strategic focus. Sector diversification follows at 35%, reflecting growing interest in industries like fintech, green energy, and infrastructure. Asset class diversification comes in at 25%, emphasizing the blend of equities, fixed income, and alternative assets used to reduce volatility and capture growth potential. This balanced allocation reflects the importance of spreading risk across multiple fronts to better navigate the unpredictability of emerging markets.

Conclusion: Where Emerging Market Investing is Headed?

Key Takeaways on Profitable Trends to Watch:

After exploring the current trends shaping emerging market investing, one thing is clear: these markets are no longer just a high-risk, high-reward corner of the investment world. They are becoming a central part of a forward-looking, diversified portfolio. Here are some key themes to carry with you as we move through 2025 and beyond:

- Tech is not just a Silicon Valley thing anymore. Emerging markets are showing explosive growth in e-commerce, digital finance, and smart infrastructure. This isn’t just about catching up; it’s about leapfrogging old systems and building something more agile.

- Green energy isn’t a luxury — it's an economic engine. Countries from India to Brazil are pouring money into solar, wind, and clean energy projects. Driven by climate goals, energy security needs, and cost advantages, the green revolution is no longer just a Western trend.

- Infrastructure is rising fast. From new megacities in Southeast Asia to transportation upgrades across sub-Saharan Africa, the need for better roads, ports, and digital networks is creating a goldmine of long-term investment opportunities.

- ESG is becoming a cornerstone, not a side note. Environmental, social, and governance factors are taking center stage as both global investors and local regulators demand more transparency and sustainability.

- Smart investing is all about balance. As exciting as the growth is, the volatility is real. Political shifts, currency swings, and unpredictable regulation can rattle even the most promising outlook. That’s why diversification, due diligence, and local insight are more essential than ever.

2025 Outlook: Are Emerging Markets Set to Outperform?

The global economy is expected to grow at a modest pace over the next couple of years. According to the World Bank, global GDP growth should stabilize around 2.7 percent through 2025 and 2026. That’s not a bad baseline, but it also means investors will be on the hunt for above-average returns. Emerging markets could help fill that gap.

Here’s where the outlook gets particularly interesting:

- Asia continues to lead but in a more complex way. China’s growth is slowing, but countries like India, Vietnam, and Indonesia are stepping into the spotlight. Their combination of young populations, improving infrastructure, and government-backed digital agendas are fueling long-term growth prospects.

- Latin America is showing signs of resilience. Brazil and Mexico, despite political noise, have seen strong inflows in 2024 due to stable interest rates, rising commodity prices, and growing tech adoption.

- Africa is drawing institutional attention. Nigeria, Kenya, and Egypt are getting traction for infrastructure and fintech development. Nigeria’s $14.6 billion pension fund, for instance, is shifting assets toward infrastructure and private equity to help bridge the country’s massive development gap.

- Middle Eastern capital is flowing into new directions. Sovereign wealth funds in the Gulf are expanding into African and Asian emerging markets, seeking diversification beyond oil and traditional asset classes.

Final Thoughts:

If you’ve made it this far into the article, give yourself a nod — you’re clearly thinking seriously about where the next wave of investment opportunities will come from. Emerging markets aren’t a magic bullet. They demand research, resilience, and a willingness to ride out volatility. But the payoff? It could be transformational, both for your portfolio and for the real-world impact your capital helps unlock.

The future of emerging market investing lies not in chasing short-term hype, but in identifying long-term trends, building strategic positions early, and staying curious. Whether you're allocating through ETFs, working with a local fund manager, or backing a new solar project in Kenya, you're part of something much bigger than just chasing returns. You're investing in the future shape of the global economy.

And let’s be honest — that’s a lot more exciting than watching the same ten stocks bounce around on Wall Street.

FAQs – Profitable Trends to Watch in Emerging Market Investing:

Q1. Why should I consider investing in emerging markets in 2025?

Emerging markets are poised for significant growth, driven by factors such as increasing consumer demand, technological advancements, and infrastructure development. Annual consumption in these markets is projected to hit $30 trillion by 2025, which speaks volumes about the scale of opportunity.

Q2. What are the key risks associated with emerging market investments?

Investing in emerging markets does come with its challenges. Political instability, currency fluctuations, and shifting regulations are common hurdles. Trade tensions and abrupt policy changes can shake things up, so it’s smart to do your homework and diversify where possible.

Q3. Which sectors in emerging markets show the most promise?

Tech, renewable energy, and infrastructure are leading the charge. India’s digital expansion, Brazil’s green energy initiatives, and Southeast Asia’s construction booms are just a few standout examples of high-potential sectors.

Q4. How can I effectively diversify my investments in emerging markets?

Diversification is key. Spread your investments across multiple countries, industries, and asset classes. You can go the DIY route or look into emerging market mutual funds or ETFs to get broad exposure with less hassle.

Q5. What role does foreign direct investment (FDI) play in emerging markets?

FDI is a major growth engine. In 2023, global FDI surged, with countries like India, Mexico, and Brazil pulling in billions. These capital flows help boost infrastructure, create jobs, and spark innovation.

Q6. Are there any notable trends in private equity within emerging markets?

Private equity is back in action. After a quieter period, dealmaking in 2024 jumped by 14 percent to $2 trillion globally. While regions like Asia saw a slight dip, many emerging economies experienced strong activity in consumer and tech sectors.

Q7. How does the performance of emerging markets compare to developed markets?

Emerging markets often deliver higher growth than developed markets, though they can be more volatile. The trade-off can be worth it if you’re looking for long-term gains and can handle some turbulence along the way.

Q8. What impact do global economic trends have on emerging markets?

A lot. Global interest rates, commodity prices, and even geopolitical shifts can ripple through emerging economies. For example, U.S. rate hikes often lead to capital outflows from developing nations, affecting currencies and liquidity.

Q9. How can investors stay informed about emerging market opportunities?

Stay plugged into global financial news, read reports from credible organizations like the World Bank and IMF, and consider tapping into insights from local experts or financial advisors who understand the region.

Q10. What strategies can help mitigate risks in emerging market investing?

Risk management is all about preparation. Perform thorough due diligence, diversify smartly, and think long term. And don’t underestimate the value of local partnerships—they can offer crucial insights that you won’t get from data alone.

TradingVortex.com® 2019 © All Rights Reserved.

TradingVortex.com® 2019 © All Rights Reserved.