Forex Scalping Meaning:

It is a very short term Forex Trading Strategy that opens and closes a position within a relatively short period of time. The Scalper enters a trade and almost immediately takes profit as soon as the trade generates a small profit.

The time frame of this technique can be typically anywhere from one to five minutes. Because of the short trading time frames, unlike other conventional Forex trading methods targeting a large pips moves, the number of pips gained from each trade is usually small. However, many Forex scalpers try to make good profits by making a series of many small trades. The trader keeps a close eye on the market, engages in quick trades and gradually stacks ups 5-15 pips.

The quick trades are entered using large amounts so that small pips scalped will still translate into large profits. For example, if a trader using scalping techniques makes only 5 pips in 5 minutes at $60 a pip he makes a $300 profit. Many scalpers make up to 40 - 50 pips for a few hours of work each day, which is roughly equivalent to $2400 – $3000 a day profits.

Advantages and Disadvantages of Forex Scalping:

Advantages of Forex Scalping:

- The biggest advantage of all is the low risks involved: Forex scalping is considered by many traders less risky because the trader spends less time on each trade. The trader is not concerned on long or overnight trades. A disciplined scalper trader can double or even triple their account spending just a fraction of the time a day trader will spend on the market, and it can generate nice profits if he makes the right decisions on when to open and close the positions.

- Scalping takes advantages of the liquidity of the currency market: Currency exchange rates are always changing based on changing market conditions. Experienced scalper traders profit from very slight price fluctuations, which may be as small as only 1-3 pips. They just stack it up and steadily build up their account. The few pips earned can translate into big profits using the right leverage.

- It does not require any technical analysis of long-term market trends: You are not limited to the current trends to make a reasonable profit. It’s because of having to follow the trends that the other methods take so long to see a profit. While conventional traders are always trying to predict currency changes or which rates are going up or down, scalpers, on the other hand, are mainly interested in the current market situation and what happens in the immediate short term. With Scalping you simply “Get in, and get out”. This allows you to make a profit without having to follow trends so closely. Which reduces time spent staring at the charts waiting for a trend shift.

- Most scalpers do not rely on the news as do regular Forex brokers: Scalpers that use the news to trade are big time traders wishing to take advantage of the first few minutes of reaction.

- Scalping method allows you to trade on your free time: This is a bonus, because you will not have to worry about your money while you’re not there. It allows you to work, sleep, or just spend time with your family, without wondering about positions you opened.

Disadvantages of Forex Scalping:

- A small pip loss can translate to losing large amounts of investment: Forex scalping is ideal for traders willing and able to risk larger lots.

- Using a large leverage plays a vital role in the success of this strategy: since the pips gained from each trade are small. It should however be mentioned that trading with a high leverage is risky as it could swing both ways.

- You may miss out on a big win by exiting the winning trade prematurely.

- Spreads can eat up your profits when the profits are not big enough.

- Not to mention that to protect their accounts, scalpers should set tight stop-loss limits.

- Many Forex brokers do not allow it: this strategy is surrounded with a level of controversy and only a small percentage of the hundreds of Forex brokers online support or encourage scalping. Brokers do not favor quick entry and exits from trades because it makes them lose money back at the dealing desk and does not allow them trade against clients. If you plan to use scalping as a trading strategy you would need to look for a broker that supports the system.

Is Forex Scalping Right For You?

To be a successful scalper, it takes certain characteristics and efforts:

While it is working quite nicely for many people, the Forex scalping is not for everyone. Because you have to make a series of small profits, you need to be patient and diligent, waiting for the optimal time to open and close positions, while paying close attention to the market movement by observing and analyzing technical charts and graphs, such as candlestick charts. If you are an impatient and impulsive individual who would rather take a chance for a big winner than playing it safe, this strategy is definitely not for you.

Attention to details is extremely important:

Due to its short span of trading time, Forex scalping demands a lot more attention and focus in order to find the optimal entry and exit points for maximum profits. You must also trade based on a solid trading strategy and not by emotional impulses or fears.

A Forex scalper needs a level of mental and physical alertness and speed:

The trader cannot afford to enter a trade and walk away from the computer as a trade can last between seconds to a few minutes. It demands an intensive monitoring of each trade, some traders use automated systems or robots designed to analyze the market trade using the scalping techniques. Others prefer to scalp the market manually.

You must take psychological aspects into consideration:

Forex scalping can involve a lot of sudden unexpected market movements, but you must be able to remain calm and stay focused. If you are a type of people who are easily disturbed by unexpected events and are likely to change your trading plans in the middle of the trade, you may be better off not to trade as a scalper. You must be able to handle stress and anxiety that come from a series of short and intense trading sessions.

Forex Scalping Strategy Basics:

- You typically watch closely the current short term trend and when you spot the signals, you enter the positions with stop-loss of about 10 pips.

- A typical time span for scalp trading is 1 to 15 minutes.

- Good currencies to trade in scalping are currency pairs with a lot of volatility within a single day but with low spreads; for example, EUR/JPY, GBP/USD, USD/JPY and EUR/USD.

- A typical target for scalping is at least one or one-and-a-half spreads.

- You will need to monitor closely and close your positions manually because setting the take-profit so low and small is nearly impossible to do with many Forex brokers.

Forex Scalping 1 minute Strategy:

As an example, I will present this 1 min scalping strategy also known as the « 15 Pip Breakout Scalper Strategy » which is specifically designed to scalp 15 pips on 1 minute time period volatile currency pair charts. With the utmost precision.

The currency pairs that can be traded are the EUR/USD, the GBP/USD, the NZD/USD and the USD/CHF and they should be traded during the European and USA sessions for the most volatility. The stop used is narrow: between 5 and 8 pips and the take profit is equal to or greater than 14 pips.

How to use the 15 Pip Breakout Scalper Strategy:

This strategy requires only two things and can be used on all trading platforms, including MetaTrader:

- The 50 period exponential moving average.

- Know how to draw a trend line.

Sell order example using the 15 pip breakout scalper strategy:

This example was chosen on the 1 minute real GBP/USD chart as shown in the images below.

Sell triggers when all of the below conditions are met:

- GBP/USD candlesticks cross the 50 period exponential moving average line from the top downwards, which means the trend has turned bearish.

An upward trend line is drawn where the prices are rising.

The sell signal is given when the closing price breaks below the trend line.

Click on the image to open the full size version!

- In this example, we have opened a sell order at: 1.28317.

- We set our stop loss at: 1.28368 which is 5 pips above the price we sold at.

- The target profit level has been set at 1.28178 which is 14 pips below the price we sold at.

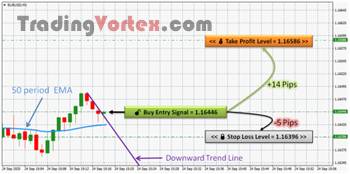

Buy order example using the 15 pip breakout scalping strategy:

This example was chosen on the 1 minute real EUR/USD chart as shown in the images below.

Buy triggers when all of the below conditions are met:

- EUR/USD candlesticks cross the 50 period exponential moving average line from the bottom Upwards, which means the trend has turned bullish.

A downward trend line is drawn where the prices are falling.

The buy signal is given when the closing price breaks above the trend line.

Click on the image to open the full size version!

- In this example, we have opened a buy order at: 1.16446.

- We set our stop loss at: 1.16396 which is 5 pips below the price we bought at.

- The target profit level has been set at 1.16586 which is 14 pips above the price we bought at.